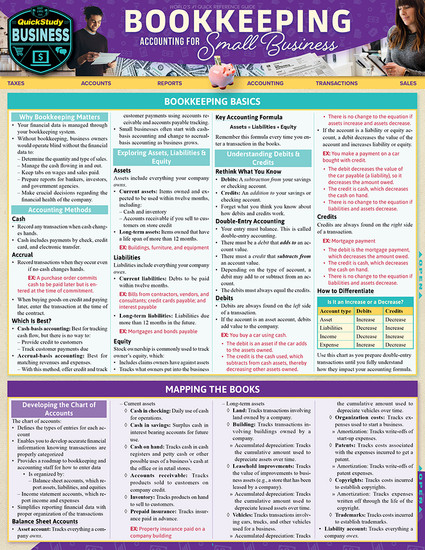

Complete and essential reference to the process of bookkeeping for your business. This 6 page laminated guide includes the facts you need to ensure a well organized system for tracking expenses and profits enabling business owners to produce reports that will satisfy bankers for loan requirements, investors for raising cash, and government agencies for reporting data accurately to avoid penalties and interest. Author of over 40 books, financial specialist Lita Epstein, masterfully designed a reference that is an expert’s concise notes for building a system and ensuring that system is thorough. As an expert or new business owner this reference can elevate your understanding and vocabulary to be your company’s financial expert.

This 6 page laminated reference guide includes:

- Bookkeeping Overview

- Accounting Methods

- Exploring Assets, Liabilities & Equity

- Understanding Debits & Credits

- Mapping the Books

- Developing the Chart of Accounts

- Using Your Business Map

- Journals

- General Ledgers

- Reports

- Computerized Accounting Programs

- Internal Controls

- Protecting Your Business’s Cash

- Documenting Transactions

- Protecting Against Fraud

- Employee Bonding

- Entering Key Transactions

- Inventory Purchases

- Hiring Staff

- Completing Government Forms for New Hires

- Determining Pay Periods

- Wage & Salary Types

- Social Security & Medicare

- Unemployment Taxes

- Worker’s Compensation

- Testing for Accuracy

- Proving the Cash & Inventory

- Finalizing Cash Receipts

- Inventory

- Adjusting for Errors

- Closing the Journals

- Using Summary Results

- Prepping Books for a New Accounting Cycle

- Steps in The Accounting Cycle

- Adding or Deleting Accounts

- Reviewing Customer Accounts

- Assessing Vendor Accounts

- Starting a New Bookkeeping Year

- Preparing Financial Reports

- Balance Sheet

- Income Statement

- Internal Reports

- Other External Reports